Crypto Trading

Investment advisory in high yield crypto-assets

Strategies

All crypto-asset strategies are designed, coded and optimised on a daily basis by Augustin Huret.

Advisory services are provided through KH sarl in France ("KH").

KH offers its strategies to its clients to enable them to benefit from the best of its know-how in quantitative trading, artificial intelligence and crypto-assets.

Objective of the strategies : The objective is to achieve a performance after fees and commissions of 8% net per month.

Benchmark : Value of portfolio

Underlying assets : Crypto currencies and Forex

Type of derivatives : Futures and perpetual futures

Leverage : 3 to 20

Strategies :

A group of 20 crypto-assets have been selected and put into real-time supervision, individually and in pairs. Twelve pair-trading combinations have been constructed and are managed in real time at several frequencies.

Since 1 January 2021, an average performance of 6% net per month after fees and commissions has been achieved on more than ten thousand transactions.

The Wunderbit platform constantly compares the performance of all traders' strategies. Our strategies are consistently in the top ten in both weekly and monthly performance.

Monthly performance of the Jasperus Crypto IV investment strategy in EUR:

Architecture:

The strategies involve investing in highly correlated crypto asset futures pairs to extract the relative changes without being exposed to the market direction.

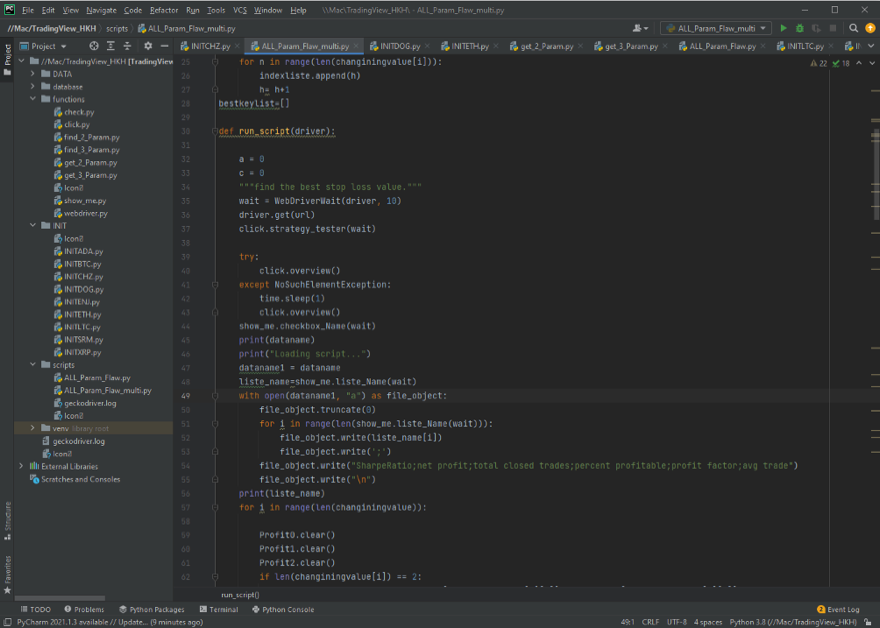

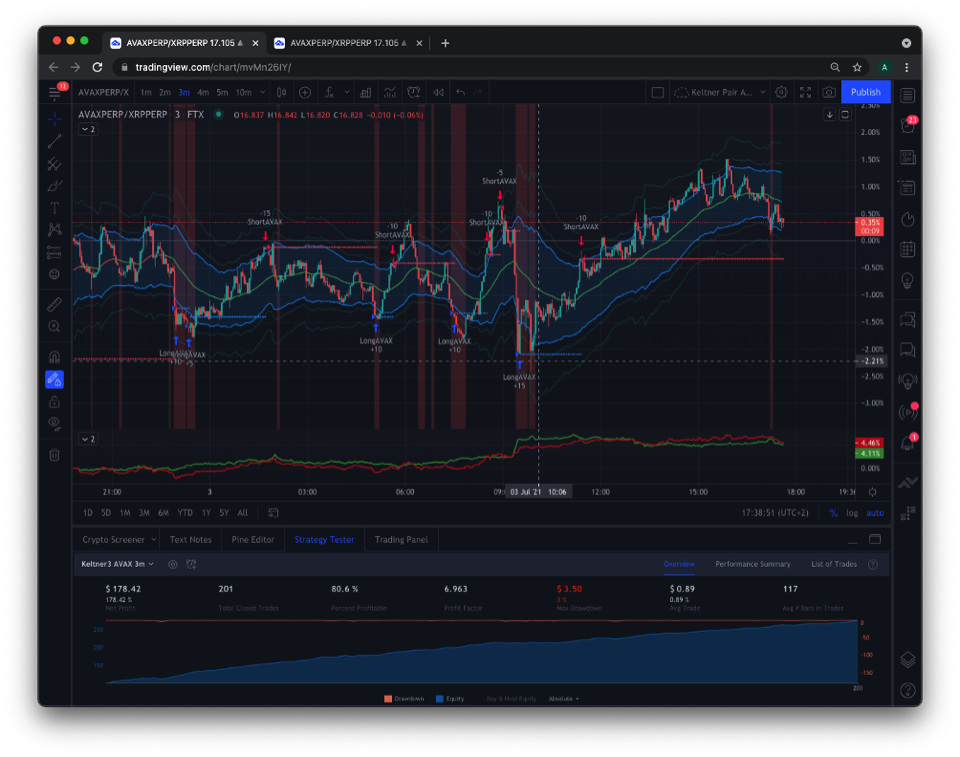

This approach allows one to avoid exposure to the sharp changes in the crypto asset market, while benefiting from the volatility. These strategies require several steps and many parameters that are all calculated and optimized on hundreds of past observations with statistical tools and artificial intelligence algorithms like Keltner, Bollinger, Mean reverting and XGBoost.

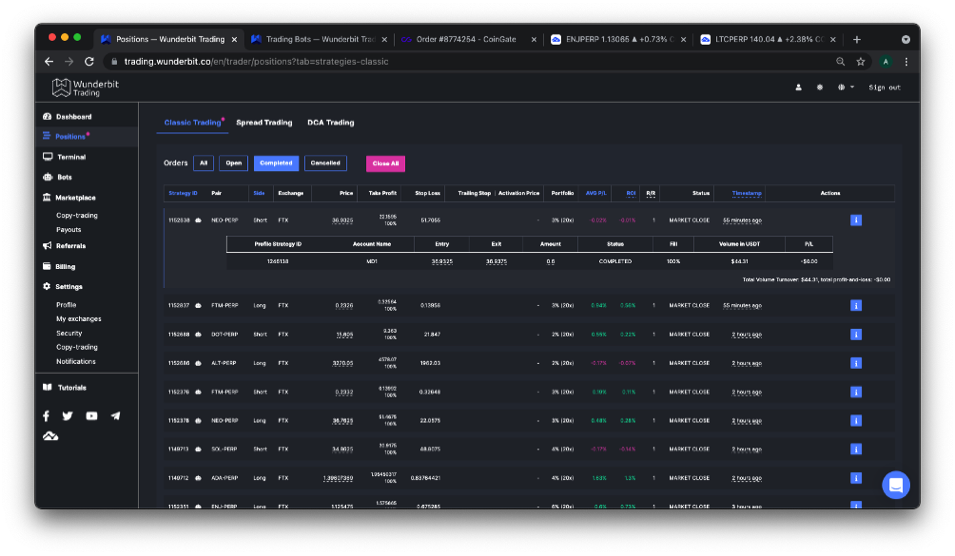

The execution of the process is fully automated and supervised by the market reference tools at the front (TradingView), middle (Wunderbit) and back (FTX) levels.

We ensure a very fine management of the parameters and a rigorous and permanent supervision of the execution.

Construction: The process consists of 5 steps:

1. Weekly study of the correlations between crypto-currencies two by two to select the most stable pairs in the long term, while having a short term volatility of about 10%.

2. For each selected pair, optimization of the mean reverting model with the Keltner or Bollinger models, optimization by learning the multiples of standard deviations for each signal level. The optimization criteria are the Sharpe ration, the net profit, and the duration in position.

3. Risk management: optimization by learning the pyramiding levels to increase the breaks if the deviations from the moving average increase in order to maximize the number of trades on each period, and thus avoid the mobilization of funds without return.

4. Daily calculation of profitability indicators and calculation of risk indicators. Optimization of allocations to minimize portfolio risks (money management).

5. Real-time supervision of order placement, execution and consistency between front and back office.

Strategies Optimisation and Artificial Intelligence: PyCharm Python

Front and Supervision: TradingView

Middleware and Money management: Wunderbit

Exchange: FTX

Risk management

Underlying risk:

Up to movement ranges of 30%, the crypto assets in the pairs are hedged. Beyond that, there are margin account funding risks and portfolio value impact risks.

Execution risk:

The automated tools and platforms implemented in our tools ensure excellent service rates and support. However, in the event of a failure of one of these platforms, an impact on the strategies is likely.

Currency risk:

The strategies are managed in US dollars. Specifically in USDT, the stablecoin that replicates the value of the USD. Values are not impacted by fluctuations in Bitcoin or Ethereum. However, the EURO / USD exchange rate will affect the equivalent value in EURO.

Interest rate risk:

Our strategies are only minimally impacted by interest rate risk.

Credit risk:

Our strategies are only minimally impacted by credit risks.

Counterparty risk:

Our strategies are only minimally impacted by counterparty risks. The lack of liquidity on crypto-assets can cause occasional order placement errors and position losses.

HKH group and KH sarl are not an investment fund. They expose strategies to their clients to allow them to benefit from the best of its knowledge in quantitative trading, artificial intelligence and crypto-assets.

EN / FR